Wills and Trusts Frequently Asked Questions

Here is a list of Q&As covering the following topics: Raha Financial Services; Will Application; My Will System; EPB Product; and EPB Calculator.

- Will drafting and safe custody services are available.

- Services for the administration of a deceased person’s estate.

- Oak Group provides local (testamentary and inter vivos) trust registration and administration, as well as offshore trust services.

R1,725.00 if Raha Financial Services is not nominated as the executor;

R632.50 for single wills

R977.50 for joint and two similar wills.

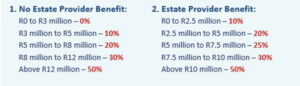

For ordinary estates and Estate Provider Benefit estates, Raha Financial Services offers a discount on executor’s fees.

Oak Group has offices in Guernsey, Jersey, the Isle of Man, and Mauritius.

Under capacity, you should indicate whether the client understands the nature and purpose of a will and also indicate if they are able to read and sign their will.

The client’s asset value should be indicated under Section 6: – Will specifications and my assets (Section 6.4).

You should indicate the age at which the trust for minor beneficiaries should terminate under any of the three options in Section 10 (Trusts) of the will application form.

The Will application form only allows for the drafting of single wills, joint wills, and two similar wills, as well as the drafting fee if Raha Financial Services is not named executor and the financial adviser fee.

My Will is available on Via under Product Providers: Wills and Trusts.

Wills of Momentum (MO): a single Will

Momentum Wills (MO): joint Wills

Momentum Wills (MO): two Wills that are similar.

Estate Provider Benefit Wills (EP): a single Will and two Wills that are similar.

You should indicate your marital status as married or civil union, living as partners, single, divorced, or widowed.

The primary client’s identity number is mandatory and marked with (*) on the system.

You can indicate whether the client wants to be cremated, buried, or has no preference.

The financial adviser should indicate under capacity if the client is over the age of 16 and if they understand the nature and purpose of a will.

The financial adviser should indicate under administrative matters if any agricultural land forms part of the estate.

The financial adviser can indicate under distribution level 2 if the whole estate must be reduced to cash, if only certain assets must be reduced to cash, or that this is not required.

To save the information already captured, click on the blue button at the top right corner (Return to Manager) and select Save.

Under record will instructions, additional information can be added under record client service details.

- Provides a better or higher discount on executor’s fees. A professional and executable will.

- Funds in the estate to cover the administration costs and other liabilities (if applicable) and testamentary trust fees (if applicable)

- Access to the Estate Provider Benefit Wills Consultancy

- A great saving in administration costs due to no executor’s fees being charged on the proceeds.

- The Estate Provider Benefit is a capital benefit designed to cover the costs involved with winding up an estate

- There are no executor’s fees on the proceeds paid from the Estate Provider Benefit.

- The Estate Provider Benefit qualifies for LifeReturns® and the Retirement Booster

- Free consultation, will drafting, and safe custody services.

The minimum insurable amount is R300 000. Having a minimum insurable amount of R300 000 exceeding the amount determined by the Minister (R250 000) available in the estate allows an executor to administer the estate. The estate will therefore never be a Section 18(3) estate.

Conveyancing fees, testamentary trust fees (the testamentary trust is created in the client’s will and registered when the client passes away), funeral costs, executor’s fees, master’s fees, advertisement costs, final expenses, vehicle transfer fees, firearm transfer/safe custody costs, and tax return fees

- If the Estate Provider Benefit is cancelled, the will shall remain valid and legally binding; however, the client will be liable for the safe custody fee.

- One cannot cede the Estate Provider Benefit.

- Each client should have their own Estate Provider Benefit will in place. Unfortunately, no joint wills are allowed. Should the client pass away and Momentum is not nominated as their executor, the minimum executor’s fee multiplied by 1.5 will be deducted from the benefit amount.

- The client will lose all the other benefits under the Estate Provider Benefit if Momentum is not appointed as the executor.

- The Estate Provider Benefit calculator can be downloaded from Via under Tools, Calculators, Financial Planning Calculators, and EPB Sales Illustrative Tool.

- LookItUP: EPB sales illustrative tool exp-2023-07-31.xlsm

The value of the client’s business interests, vehicles, and cash or investments

The Estate Provider Benefit only calculates conveyancing fees, executor’s fees, and master’s fees. Estate duty, capital gains tax, and any accrual or maintenance claims should be calculated separately and added to the liabilities section.

The fees listed under “other professional fees” are the master’s fees, firearms, tax returns, and avert costs.

Yes. The instant cash benefit is 10% of the minimum Estate Provider Benefit needs, limited to a maximum of R50 000.